My Journey from Captive to Independent

"Among the two best decisions I've made in my life were to join FFC, and resign from FFC sixteen years later. I should have done both of them sooner." -Michael

This is the story of my 16 year journey with a large financial company, my subsequent resignation and re-birth as a builder of new and modern securities-focused Group of Advisors. I shall refer to company in question as "Former Financial Company" or "FFC" for short.

Photo: AylaBaha.com

Thanks for Peeking Over the Fence

So, gentle reader, I applaud you for reading this and looking "over the fence". I know it's difficult. In my sixteen years at FFC I was prospected by a lot of firms and I rarely gave them the time of day. However, the industry improved dramatically and I felt compelled to (finally) explore beyond the bubble I was in. FFC is no longer the "only game in town", and it just makes sense to investigate all business ventures; if for no other reason than for your clients and your downlines.I've been helping FFC Agents (and those from other firms) become Professional Financial Advisors since 2006. If you are securities focused and if you take a client-first, recruiting-second approach then I think you'll enjoy our company.Please be aware that there is life after FFC! There are viable alternatives. FFC does not have a monopoly on "the Crusade", and though they may do the right thing for consumers, in my opinion they don't necessarily do the best thing for consumers. Whatever you can do at FFC, you can do better as an independent (which we are).You make up your own mind after reviewing the content below and doing additional research. I thank you again for your time and your open mindedness. I invite you to take me up on my offer and contact me.

Hard Questions I Asked Myself

If you could offer products with more benefits and were less expensive than most product offerings at FFC, doesn't the Crusade obligate you to do so for your clients?

Where is your loyalty strongest: toward your clients or toward FFC Corp? If the two were contradictory, who would you serve?

Would you like to build a true residual income without having to recruit?

If you do want to build a sales force, would you like to have an override system built on top of a residual income? (Hint: it's about securities.)

If there exists a business system that has essentially the same structure as FFC but can offer your downlines more income for their families and more freedoms, don't you owe it to them to thoroughly research it?

How many reps do you personally know of who can support their families solely on their FFC income?

We Took Porsche's Advice

I was in FFC for 16 years, and a Branch Manager (I'm using a different title here) for 8 of them. I got my start with the predecessor of FFC in 1989. The most I ever earned in a 12-month period was $84,000, and no one in my Base Shop broke $50,000 (only a few broke $25,000).By 2005, I became increasingly frustrated with the overwhelming focus on mass-recruiting, the lack of focus on investing, the very limited product options available for my clients (in particular term life, 529-plans, 401k-plans and variable annuities), and the terrible securities compensation structure.I was at a point where it was difficult for me to stand in front of a group of hungry minds on a Thursday night Opportunity Meeting and "sell the dream", while I was living a nightmare. I could no longer sit across from a prospect, look him in the eye and bring him into FFC knowing what a hard, difficult and heartbreaking struggle lay ahead of him

Of course the first thing I did was question myself; I didn't question FFC - I was loyal and was taught to never second-guess the "Mothership". The message from FFC and my peers was, "It's your fault. You're not working hard enough. You're not committed enough. You don't believe enough." Really?!- I'm not the smartest person, but I'm not an idiot.

- I'm not the hardest worker, but I'm not lazy.

- I don't have the finest "people skills", but I can get along with the human race adequately well.

- I'm not a master motivator, but I can inspire with the best of them.I had a suspicion that problem may not be me. Could it be the FFC system? Was it possible that I (and my team) be successful elsewhere? I decided to re-evaluate everything from scratch.After researching other firms, both captive and independent, I resigned in 2006 (along with most of my team) and decided to try my luck at another MLM-type company (similar to FFC). We had tremendous success at first (fastest to "NMD" in the company's history and "Rookie of the Year" after being there for only two months). However, by the summer of 2007 we concluded that the company was not much better than FFC. I banded together with my top Advisors and a small group of former FFC Branch Managers, and we had the crazy idea to start a new company from scratch and do it ourselves. It was to be based upon a modern, open-source, transparent and independent architecture.

Results

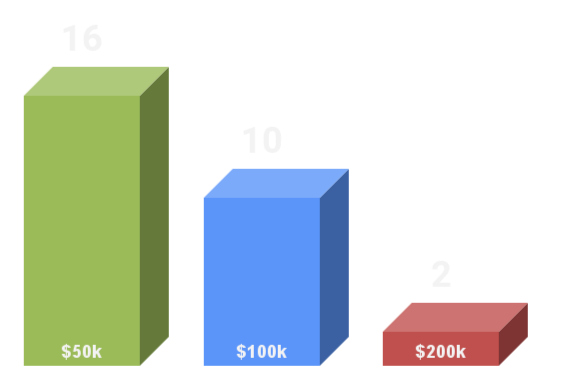

Result: as of this writing my organization has between 25 - 30 securities-licensed Advisors, and I've helped develop ten $100,000+ earners (none have MORE than two Advisors on their "team"), and an additional nine $50,000+ earners. And I've broken $200,000 in override-income that is not based-upon charge-backable life premium. Maybe most importantly, we teach advisors how to build a residual income without having to recruit.I have part-timers who earn over $100k merely from residual securities income.Beyond the financial rewards, I felt like I got my life back and I was part of the human race again. No more prospecting the 19-year old waitress, no more meetings on weekends and holidays. I wasn't looked upon by friends and family with suspicion as an "MLM-junkie". I re-built relationships with friends who were not agents in the company (or even clients). I felt "normal" again (that's a good thing).

Sampling of our Top 17 Improvements

"Our firm's roots are in FFC's predecessor, but we have improved on the original model, and built a modern and innovative firm that is very securities focused. We also take this business very seriously, and don't treat it like a "hobby" or a "sports event". -Michael

We asked ourselves, "If we could start over again, what would we keep the same, and what would we improve?"Then we set out to do that in the spirit of Bruce Lee's wisdom...Twenty years ago FFC was the only game in town.... both regarding term insurance, and building a part-time financial services opportunity. However, the landscape has changed. It is a different era now. FFC has stood still while the rest of the industry has improved dramatically. Other companies (some lead by ex-FFC'ers) have made improvements in products and business models.

Do you think FFC is the only company with good ideas? Isn't it possible for others to improve upon FFC? If you were to leave FFC for whatever reason, and had the funding to start your own financial services company, how would you design it? Would you really build your new venture exactly the way FFC is currently structured? Or, would you make improvements? Open all product lines up to multiple vendors? Increase commissions? Allow more freedoms for the sales force? Remove "forced" recruiting? Eliminate replacement? etc.Odds are, we made those very same adjustments.So lets take a look at a short list of the 18 most important improvements we made (there are many, many, more). These are not listed in any particular order, and some have been curtailed due to compliance reasons. If you contact me I will give you the full details. Each item has much, much more depth to it (remember, the devil's in the details).

#1: The New Crusade

We believe that retirement income planning is the new crusade. Every financial planner I know worth his salt sells term insurance. The "term crusade" is over. The war was is won; stop beating the horse. Our firm was built from the ground up on the premise that securities, particularly retirement, was of most importance. Not only is investing more critical for the client than insurance, but there is much more business/revenue to be captured for the Advisor.We are defined not only by what we market, but by what we don't market. We don't sell UL, VUL, indexed-products etc. We're 100% term (from many carriers not just from one). We don't sell index-annuities, which FFC has started selling (they are the "whole life" of the investment world)!In regards to term insurance, I believe I am more "crusade-like" now than when I was at FFC! Why? I can market the best term for my client, because I have choice. (See #2 below). At FFC I wasn't really selling term. I was selling "FFC's Term" - there's a difference.

#2: Be an Advocate for the Client, not the Company

When I was at FFC, I was a "bannerman for FFC"; the entire conversation was about how awesome FFC is, how great the products at FFC were, FFC was the only company doing "the right thing", FFC, FFC, FFC.Now, my entire conversation is about the client. What are their goals, what strategy is best for them, and which products and companies will solve their problems the best. I am now a "bannerman for the client".My loyalties are truly with those I serve, not the carriers. I couldn't care less about the vendors and product providers. I'm an advocate for the best interest of my clients because I'm not tied to one company (or a small subset of firms), instead I let the insurance & investment companies "duke it out" and then just select the best.

#3: The "Right" Thing vs the "Best" Thing

Marketing term insurance is the "right" thing. But, can marketing only one carrier possibly be the best for every client, every time? Marketing variable annuities is the "right" thing, but is having just one or two carriers the "best"?In order to do the optimal thing for your clients, you must have choice. Imagine finding out your doctor was only able to prescribe medicine from one pharmaceutical company, would you trust her?A related concept is to keep the sales force separate from the product providers. The financial philosophies of FFC are sound, but the implementations are flawed. One of the miscalculations was tying the sales force to only one or a limited number of product providers. A distribution channel should be completely separate from the product vendors, thus giving Advisors true freedom and choice in servicing their clients.

#4: Advisor First

Focus on the Advisor, not the "mass-recruiters". Allow recruiting, but don't mandate it. Instead of being a MLM-company that happens to sell term insurance (FFC); why not build a financial planning company that happens to allow you to build a salesforce, if you choose to.We don't require recruiting for any promotions. We teach how build a profitable client-base with residual income (this is better than overrides). We teach how to really get referrals, and how to handle large securities cases, and become a professional Advisor.

"None are more hopelessly enslaved than those who falsely believe they are free."-Johann Wolfgang von Goethe

#5: Do term the right way

Do term the right way. FFC's "Buy Term & Invest the Difference" concept is correct, but their implementation of it is mediocre, at best. When the life insurance industry got it's butt kicked by FFC in the '80's, they didn't roll over and die. Instead, they took the approach of, "In addition to competing with FFC using cash-value insurance, let's beat them at their own game." So, over the last few decades they've created term products that are better, more innovative and cheaper than FFC Life's term. Today, term insurance is a commodity. Most policies are very similar, and are only differentiated by underwriting guidelines, term length and price. Following are just a few issues (there are more) I've found with FFC's term that you can see for yourself by looking at your client's actual FFC life policy.1. They're only guaranteed for 20 years, regardless of the length. So, a 30 year or a 35 year term is only guaranteed for 20 years, the remaining years are "scheduled" which means the rates can go up. As far as I know, no other carrier offers scheduled premiums anymore - they offer guaranteed rates only.

2. When FFC term runs out, it is renewable, but only to annual renewable term or decreasing term, NOT level term.

3. FFC rates are very, very high. Run your own quote here.

4. Rates are unisex. FFC charges the same for both male and female even though statistically females live longer. All other providers I know of rate males and females separately, which is more fair and less expensive.

5. Your client is stuck with one carrier. If your client is declined or rated by FFC, you have no other options. We have sub-standard carriers, so we can cover almost anyone.

6. The maximum conditional coverage is $500,000. Many carriers offer up to $1 million in conditional coverage.

7. FFC combines husband and wife on one policy. They claim the "benefit" is that the combined face amounts qualify for higher breakpoints, thus reducing the costs. True, but let's dig deeper:

1. The "reduced" cost is still more expensive than two separate, independent policies.

2. You are forced to use the same carrier on both spouses. By separating the husband/wife, you can write each up with a different carrier, if needed.

3. The terminal illness benefit is only on the primary, not the spouse. In the independent market both can get TIB because they have their own policies.

4. Only the owner has control; the spouse has no rights. If there is a divorce, the owner can keep his ex-wife on the policy and keep himself as beneficiary. But he can change his beneficiary to his new girlfriend!

5. Upon divorce, you must remove the spouse rider from the main policy. Then you write up a new policy on the spouse, at her current age. You only get paid on the premium increase (if there is one).

6. If the owner dies, the spouse rider drops off and she needs to get a new policy.

7. Same-sex marriage/partnerships are problematic or impossible in many states if they are combined on one policy.

8. Replace FFC and Invest the Difference. We regularly replace FFC's term with less expensive term and often increase the face amount while simultaneously increasing the length of guaranteed term. Take a look at my FFC Replacements Spreadsheet. Study it carefully! Notice how we take the savings from replacing FFC's term and invest the difference!Finally, we offer the complete "Protection Package" which is term life insurance + living trusts (not merely term insurance).

#6: Extreme limitation of product choices

Extreme limitation of product choices. Financial services is a very competitive landscape and to doom your clients to only one, or a few, vendors is unconscionable. No company, no matter how good, can provide the best features, and the best service, at the lowest cost, to all consumers in all situations. You must have choice.1. We offer most major mutual fund and variable annuities in the independent market, and we can add the most innovate products coming onto the market (which we regularly do).

2. FFC offers only a dozen of mutual fund families (there are multiples of dozens available in the industry), of which Legg Mason and Invesco are aggressively pushed by corporate, due to "revenue sharing" agreements.

3. Variable annuities are the fastest changing segment of our industry and an Advisor must have access to all of them (or at least most) in order to do a good job. Also, no "L" share is available on the FFC VA. L-shares offer a lower CDSC for clients if they want more liquidity. Also, no "C" share option for Variable Annuities, which has either zero CDSC or only one year.

4. Two 529 plans, not including the American Funds College America which, in my humble opinion, is one of the finest in most cases.

5. No "C" shares available for mutual funds, only A-shares. C-shares have no front-end load and are good for short-term situations.

6. FFC offers only two or three 401k plans. We have access to just about all of them available in the independent market.

7. There is much, much more to this....

#7: Securities Compensation

There are many, many problems with FFC's securities compensation structure. Due to compliance proprietary issues I can't list them, but if you contact me I will give you the run-down. But here are some ideas to think about...1. We focus on building a residual income for Advisors (without recruiting). This is accomplished via securities 12b-1 fees, c-shares, trails on variable annuities etc; and we do this for Advisors at all levels. We encourage building a residual income, without having to recruit.

2. We have ownership of our client book-of-business.

3. We don't lock commission rates on old accounts. In other words, if you are at 25% commission level when open a trade, and the client adds money to the account three years later, and now you're at a 45% level, we pay you 45%on this new money!

4. We have c-share mutual funds, and a large number of payout options on variable annuities (trading-off upfront vs trails), that you can choose on a case-by-case basis.

5. We pay up to 70% full securities commission, with no breakpoints or "haircuts" on variable annuities.

6. Again, there's much, much more.

#8: No "Replacement" for Branch Position

No give-ups, replacements, or "promotions-exchanges" when becoming a Branch President. Never "lose" anyone you've hired. If a downline "passes you" and becomes a Branch President, you will re-gain them as a 1st Generation Branch once you become a Branch President! The "give-up" system is the most abusive concept in network marketing. Euphemistically named "replacement", "promotion exchange" or "franchise fee". This was the first thing we eliminated. If you recruit someone, they will be in your hierarchy forever. If they "pass you up" their production still counts, and you can always "re-capture" them.

#9: Promotions/Commissions are Unique to Each Product Line

At our firm You may have "commission X" for life insurance, and "commission Y" for securities, etc. Each product has it's own promotion guidelines based upon that product's production only.

#10: No Recruiting Requirement

No recruiting requirement for any level. If you do build a team, then their production does help you get promoted, but you could attain all level solely on personal production, including Branch President / Franchise Owner.

#11: We are liberal in allowing outside financial business.

At most firms you are limited to marketing the products they allow; and only those products. They won't even let you offer financial products that aren't available through them! Here is a sampling of products that you may want to help your clients with (we allow you market these, but you still need prior approval, of course):1. Mortgages

2. Health insurance.

3. Real estate.

4. Car & homeowners insurance (the P&C referral program doesn't count).

5. Disability insurance.

6. Commercial loans.

7. And any other financial products that FFC doesn't offer.

8. We allow you to earn a CFP or other financial planning designations, and promote it.

#12: Ownership

1. With us you'll have ownership of your book-of-business (with some "common sense" caveats, of course) the moment you are fully-licensed. We also have a true franchise opportunity for Branch Presidents. Tell me, as an agent why is it to your benefit to have a non-compete clause in your associate agreement? Are you aware that if you leave most firms, technically they own your client accounts, not you?

2. At our firm we have a clause that in layman's' terms states that if you ever change my broker/dealer, our firm will not prevent you from servicing your clients at a new broker/dealer, assuming the clients want to follow you, of course.

3. Many firms prevent you from leaving by using "golden handcuffs and a golden cage. Sure, you can leave, but don't take "our" clients with you, nor can you contact your downlines. Huh? I thought I was building my own business? "A company within a company.... be in business for myself but not by myself", and all that rhetoric. That is just standard "MLM talk". Look at the contracts.Fraternizing with the "Enemy". When I was at FFC I was strongly discouraged from associating with anyone in the financial industry who was not with FFC. The biggest mistake I ever made in my professional career was staying with FFC for as along as I did. It hurt me, it hurt my clients, and most importantly, it hurt the people who were following me. Had I been able to mingle with other advisors in financial services, I probably would have broken out of my naivety much sooner.

#13: No Networking Agents

FFC required me to "network" downline agents who were 50 miles away from my branch to another office (thus losing a minimum of 25% - 50% of their revenue). We don't. You can hire an Advisor anywhere that you are licensed ,and they are part of your Team 100%. We do not believe in "networking" Advisors.

#14: Reasonable Recruiting

After 16 years at FFC, and then having helped build our new firm, I have experienced a number of epiphanies regarding recruiting, multi-level marketing and sales-force structures...Those who are successful in FFC are expert network marketers. Those who are successful with us are competent Advisors. One of the reasons I left was that I felt FFC was moving in the direction of "selling-insurance Amway-style". Recruit everything that moves, get 'em licensed with a term-only license, neglect securities, get 'em out in the field, get the premium (so the Branch Manager can get his bonus), then hope the new recruit "makes it".I was disgusted with an environment that encouraged, even demanded me to recruit, recruit, recruit. I was getting tired of trying to recruit everyone I met. Sometimes I just want to meet someone and not try to recruit them, and not feel guilty about it. I was getting frustrated with the obligation of having to prospect the 19-year-old waitress. I want to recruit people who want to be financial services. I don't want to recruit just to get points on the board.I dreamed of an environment that recognized all types of producers and builders. If you want to only produce and not recruit - great! If you desire to be a huge builder - great! I'm tired of only the mass-recruiters making all the money and getting the recognition.I do believe in the multi-level-commission-structure (within reason), but I don't want to take 100 hiring packs and only get 10 licensed reps. That means 90 people invested a sign-up fee, and their time, and their expectations, and got nothing. Instead of a the typical MLM/network-marketing system we wanted to implement a rational, sensible sales management system. How about truly informing prospects of what is involved in become a professional advisor, and then actually preparing them to be competent in the field and making money. Isn't that better?You want the real, hard-core truth? One of the pleasant surprises after months of leaving FFC, is that I felt "normal" again! For 16 years I was trying to recruit every person I met. Now, that pressure wasn't on me anymore, and it felt liberating. I could go to a social function, family event, meet someone at Starbucks and not try to navigate the conversation towards business or recruiting. I felt like I was part of the human race again.A few more recruiting epiphanies:1. You'll recruit more effectively by recruiting objectively and selectively.

2. Don't recruit just because you can, but because you want to. Don't recruit to get "points on the board" or to amass an army of code numbers, but for a specific purpose, which is to develop competent, independent Advisors.

3. Do prospect many, but don't recruit everyone.

4. Always recruit for the right reason. Sometimes we allow contests, promotions and recognition to cloud our judgement. But you don't help yourself, or your prospect, when you recruit someone who isn't right for the business or isn't ready at this time. In fact, this is what can give you a "MLM / Network Marketing" image. A person who is ready now is also going to be ready tomorrow or the next day - there is no need to "pressure" the prospect to join immediately. In fact, by being low pressure and giving your prospect "space" until she is ready, you will build respect and credibility.

5. If you don't like someone and don't think you would enjoy working with him, don't recruit him!

6. It takes about 50 hours of one-on-one personal attention to develop someone into a Competent Advisor. This includes one-on-one coaching, field training appointments, phone conversations, webinars, email etc. When you hire someone you need to assume that they are going demand these 50 hours from you. So, recruit "the masses" with that in mind.FFC recruits to make it work. We recruit because it works.

#15: Image and Public Perception

FFC is a network marketing and multi-level marketing company, that happens to sell life insurance. We are a financial services firm that happens to allow Advisors to hire others and build a team (if they choose to).

Wouldn't it be nice to prospect someone and not worry that they'll Google your firm and read that its just a MLM?

#16: Actual Training

My experience was that FFC has a "R & R" strategy, which is "Recruit and Rah-Rah". Recruiting a greenie and using them to get clients takes precedence over building a solid client base. Motivation takes the place of training.

Our strategy is to train Advisors and actually teach them the fundamentals. We teach you how to market yourself and get referrals.

#17: Culture not Cult

How you run your business is almost as important as the mechanical, technical and procedural issues. We spent enormous effort in improving the culture of our sales force compared to what we were used to at FFC.* Many FFC Leaders (not all) exert tremendous pressure on Reps to go full-time. We don't pressure Advisors to go full-time. You're an adult, you know what's best.

* Reps are often cajoled into attending every meeting, all the time (which are more often than not thinly disguised motivation and "pump-up" sessions). We don't pressure Advisors that way. We encourage meeting attendance, of course. We treat people like adults. We also broadcast our meetings over the Internet, and record them for later viewing. We don't run any meetings on weekends or Holidays (no "Saturday Training"). We give you your life back.

* One of the messages in FFC is that anyone who has a "j.o.b." is a "dummy". Everyone should be in FFC. We don't believe that. There are good careers other than financial services. We recognize that sales and entrepreneurship is not for everyone.Another FFC misguided message is that anyone who is in financial services but not in FFC is "evil". Notice how few (if any) Financial Advisors join FFC if they already have experience in the industry. We believe that there are good people outside of our firm, some of which we will attract to our firm, and some we won't. That's ok.

11 Red Flags it's an MLM

Red Flag #1

Be wary about buying sophisticated financial products from someone who is also trying to “recruit” you.

Red Flag #2

If they claim that anyone can do it ... it’s an MLM.To be successful in any real, legitimate business one must employ a high level of competence, exceptional hard work and diligence. If they tell you “everyone can be successful at this”, it not a real business; it's a trap!Simple test: check the rep turnover.

Red Flag #3

They’re your client accounts. You shouldn’t lose them when you leave. You should be able to take your book-of-business (and reps) with you if/when you leave the firm.

Red Flag #4

If your company tells you to “Aim for a recruit; miss with a sale"... it’s an MLM.Their focus is more on “recruiting” than client service.

Red Flag #5

It’s an MLM/Pyramid Scheme if you get tremendous pressure to go full-time and quit your "j.o.b." (just over broke).The implication is that there are no “good” jobs and the MLM you’re in is the only “real” opportunity.This peer-pressure forces part-timers to give up the security of their job and often leads to a slow, painful decline into a life of struggle.

Red Flag #6

If they’re promoting an attitude of…"We're the best and the only choice. Anyone not doing our business just doesn't ‘get-it’ and there must be something ‘wrong’ with them. Everyone should be in our business.”...it’s an MLM.

Red Flag #7

If there is excessive emphasis on meeting attendance, which is predominantly focused on recruiting and “rah-rah” (as opposed to technical training and education)......it’s probably an MLM.

Red Flag #8

If you find very few people earning a respectable income without recruiting......it’s an MLM.

Red Flag #9

If the product-providers and the salesforce are owned by the same company…...it’s probably an MLM.Pro-tip: the distribution channel should be separate from the product providers, thus giving salespeople true freedom in servicing their clients.

Red Flag #10

If you don’t find many experienced industry reps transferring into the salesforce…...it’s probably an MLM.(If they won't work there, why should you?)

Red Flag #11

If you have to recruit to advance in promotion and/or win contests, instead of pure revenue......it’s probably an MLM.

Financial services can be complicated and the true differences between companies, products and compensation don't become apparent until you dig a little deeper. There's often more than meets the eye - the devil is in the details.If you are a mass-recruiter; someone who can “move the masses” and motivate large groups of people and build a hierarchy of 1,000's of people, then FFC is for you. If, on the other hand, you want to be a professional financial Advisor first, and then possibly hire & train quality people and build a team, then you may enjoy our firm.If you are interested in a progressive venture with dramatically improved commissions and overrides, cutting-edge products, and a more liberal business model, feel free to inquire. I'd love to tell you more of our story.

My Offer

I've seen FFC grow, expand, even dominate the insurance markets. And, I've seen the tremendous challenges and missteps FFC has made since 2006. I can certainly empathize with "FFC'ers" who find the current environment troublesome and disturbing. I'd like to help, if I can, and to that end, here's what I offer:An informal chat, and a second opinion.You're welcome to meet with me via phone, email, Google Meet, or, if you're local, come by my office in Orange, CA and sit with me for a while. I'll ask you to outline your career goals – what you're trying to accomplish in the Financial Services Industry.If I think FFC continues to be well-suited to your long-term business objectives – in spite of the current crises facing FFC – I'll gladly tell you so, and send you on your way. If, on the other hand, I sincerely think working at an independent firm, such as ours, is better for you, I'll tell you why, in plain English. And, if you like, I'll put a written strategy together to help you build the business you want, whether that is as a solo Advisor, a sales manager or even a Franchisee.

Subscribe to my free weekly Advisor Training email newsletter. It includes a variety of training based upon the fantastic work of Nick Murray.